Contact Us: +1 (778)-869-4584

Why You Need a Homecare Assistance Plan

Fact 1: High Probability of Needing Care

Statistics reveal that 70% of individuals aged 65 and over will require some type of personal care in their lifetime. To put this into perspective, only 4% of people will experience a car accident in their lifetime.

Fact 2: Homecare Assistance and Long-term care are not free

Many Canadians think all aspects of healthcare are free. They are shocked when they learn that they need to pay for home care, home support or long term care after they or their relatives are sent home from the hospital.

Government homecare services are limited, offering minimal support. For instance, there is no coverage for instrumental activities of daily living, such as laundry, grocery shopping, which are crucial for maintaining independence at home.

Fact 3: Coverage Beyond Aging

Homecare assistance benefits are not just for the inevitable frailty and aging. They also provide vital coverage for life occurrences at any age, including accidents, injuries, fractures, illnesses, and recovery from surgeries.

Fact 4: The Preference for Homecare

Given the choice, most people would prefer to remain at home when they need personal care, rather than moving to a facility. Studies show that receiving care at home contributes to longer life expectancy and a better quality of life.

Fact 5: The Role of Family Members

Family members typically prefer to act as care managers rather than primary caregivers. This allows them to support their loved ones while still managing their own lives and responsibilities.

Fact 6: Gaps in Traditional Health Plans

Both Living Benefits and Individual Health plans have significant gaps in coverage. These plans are not intended or designed to cover the often expensive costs of home care, leaving individuals without sufficient support.

Issues with government-funded

long-term care

Introducing MyDignity, a one-of-a-kind, affordable, tax-effective, and easy-to-obtain homecare assistance plan. MyDignity boasts a 95% approval rate and is often referred to as a gift for Canadians.

No Medical Required: Approval is immediate, based on the acknowledgment of a Simple Health Declaration, which even accepts individuals with Type 2 diabetes, certain cancers, and heart conditions.

Wealth Preservation: MyDignity plans offer $250,000 in tax-free family coverage, helping protect your savings and preserve your wealth.

Full Control: You have 100% control over who, what, when care is provided.

No Waiting Period: Eligibility is immediate upon submission of a simple claim form signed by your doctor.

Flexibility: You have the flexibility to direct your care whether that is personal care, homemaking, or community outings.

Do you want to learn more about your healthcare options?

Please watch this presentation to know about personalized care plans that cater to your unique needs

In this short presentation, you’ll discover:

How MyDignity Homecare Assistance Plan can help you preserve your retirement money.

The benefits of each MyDignity plan, tailored to provide financial and emotional support.

How our plans cover essential services like nursing & caregiving, specialized therapies, medical equipment, respite services, and even prepared meals and transportation expense to and from medical appointments.

Join thousands who have found comfort and confidence in MyDignity Homecare Assistance Plans

Watch the MyDignity PREsentation now—because the future of care starts with you.

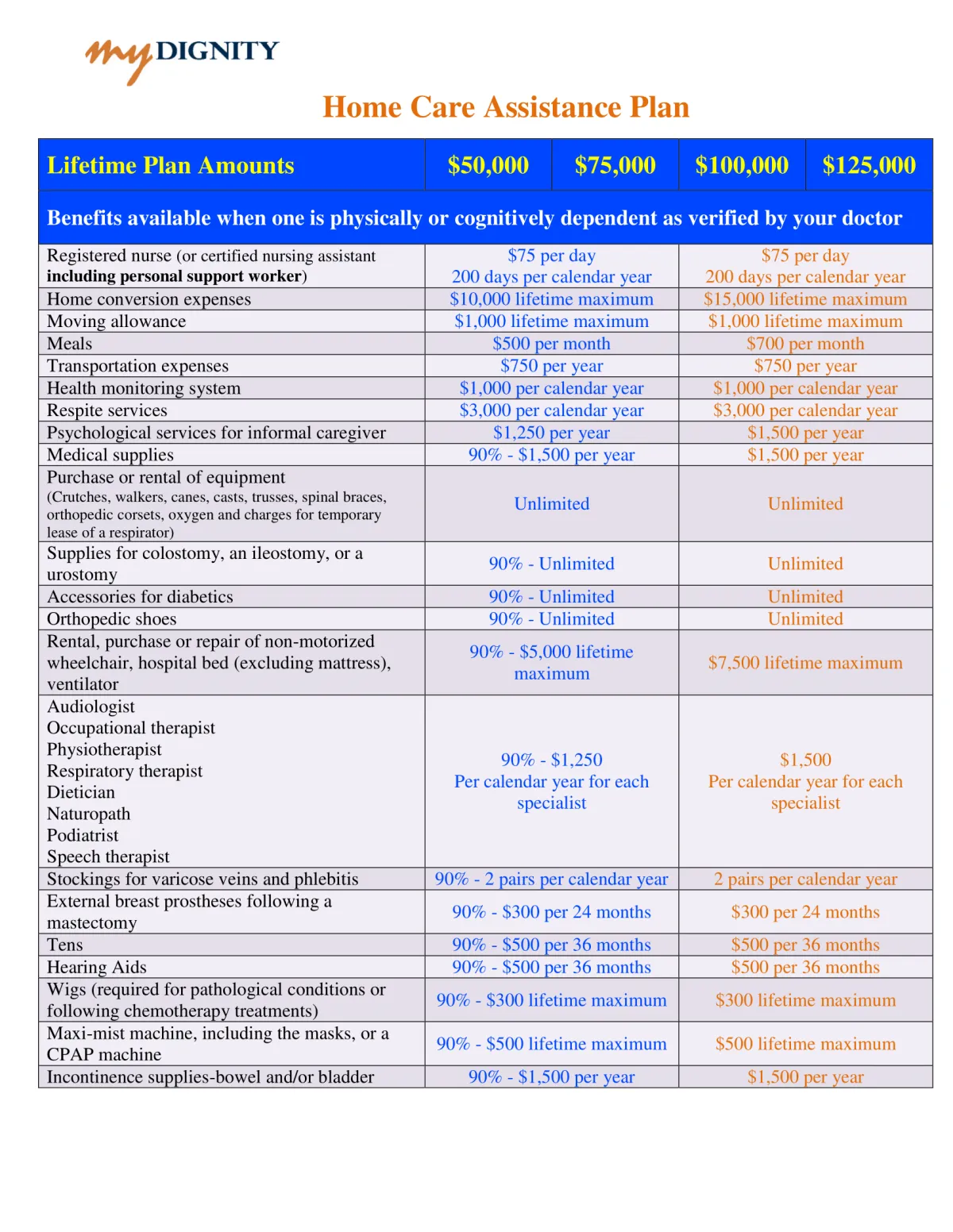

The MyDignity Home Care Assistance Plan has four types of plans, which offer varying levels of coverage. Here’s a summary of each:

Plan 1: Provides a lifetime coverage amount of $50,000. It includes benefits for various medical services and supplies, with moderate limits on additional benefits such as meals, transportation, psychological services for caregivers, and medical equipment.

This plan includes a mini-health plan covering diagnostic lab tests, hospital room upgrades, access to second medical opinion outside Canada, etc.Plan 2: Similar to Plan 1 but with a higher lifetime maximum of $75,000. The benefits and limits remain largely the same, providing enhanced financial protection over a longer period.

Plan 3: Offers a lifetime coverage amount of $100,000. It provides higher allowances for some benefits, such as meal coverage, home conversion expenses, psychological services, and specialists, making it suitable for those needing more comprehensive support.

This plan includes a mini-health plan covering diagnostic lab tests, hospital room upgrades, access to second medical opinion outside Canada, etc.Plan 4: The most comprehensive, with a lifetime maximum of $125,000. It mirrors the benefits in Plan 3 but with enhanced financial limits on some benefits, making it ideal for extensive long-term home care needs.

Each plan type increases in both total lifetime coverage and the scope of specific benefits, catering to different levels of need and budget.

Frequently Asked Question

For the prepared meals, can the policyholder claim for fast food meals delivered to their home?

Yes, of course, all they need is a receipt of the food order for the insured and proof of their payment for it and they will be reimbursed up to the monthly maximum from wherever they order from – as long as it is a fully prepared meal outside of their residence.

How is the age computed? Is it actual age?

Yes, it is actual age of the applicant

For the respite services, should the respite care be at home? Or can the patient be brought to a place that offers respite care for a day or 2?

Respite care at a location that offers Respite service is covered as long as the receipt indicates the service is for Respite Service.

If the policyholder is on claim, do they have to continue paying the plan?

When a person is on a home care claim the premiums are waiveduntil they recover back to good health.

Is there discount if paying annually?

Yes, they save about a month of premium.

How long is the waiting period before a policyholder can make a claim?

There is no waiting period for benefits to be payable. If the person becomes functionally dependent according to their doctor, they can make a claim right away.

For the mini health plan, is there a deductible?

There are none.

How is the plan tax-efficient?

The plan as a whole qualifies as a PHSP (Private Health Services Plan recognized by CRA) whereby the premiums can be used towards either the Medical Expense Tax Credit, or as a business expense if one is a sole proprietor/partner or runs a corporation.Either way any benefits received are non-taxable.

Can payment to a family caregiver be reimbursed?

Not if they are living on the same roof. The caregiver has to be certified.

Can monitoring devices be claimed?

Yes, when they are on claim. If they bought the device before they made a claim, it is not covered. If they are paying a monthly subscription for the monitoring device, they can reimburse for the month they are on claim.

At Senior Secure Canada, we specialize in providing financial solutions that ensure guaranteed income for life, helping you retire with peace of mind. With personalized strategies tailored to your needs, we help you navigate retirement without the stress of market risks.