Contact Us: +1 (778)-869-4584

Investments and Registered Plans

Investments and Registered Plans for Seniors

Planning for Retirement with Confidence

As a senior, your financial priorities shift toward preserving your savings, generating income, and ensuring security. The following investment and savings options are designed with these needs in mind, offering tax benefits, income flexibility, and capital protection.

Registered Retirement Savings Plan (RRSP)

Tax-Deferred Savings for a Secure Retirement

An RRSP is a tax-sheltered account allowing you to save for retirement and defer taxes on the growth. While RRSP contributions reduce your taxable income, withdrawals during retirement are treated as taxable income. Typically, seniors use RRSPs up until they reach age 71, at which point these accounts are converted to Registered Retirement Income Funds (RRIFs) to generate retirement income.

Key Benefits for Seniors: Tax-deductible contributions lower taxable income while you're working, and deferral of taxes on gains until retirement helps grow savings more efficiently.

Important Considerations: RRSPs are more beneficial for those whose income drops in retirement, potentially lowering their tax rate. Seniors approaching age 71 should review options for converting their RRSP into retirement income.

Tax-Free Savings Account (TFSA)

Flexible, Tax-Free Growth for Any Retirement Need

A TFSA allows you to save tax-free, regardless of income level, and provides flexible withdrawals in retirement without tax consequences. Since TFSA withdrawals do not count as taxable income, they do not affect eligibility for income-tested government benefits, like the Guaranteed Income Supplement (GIS).

Key Benefits for Seniors: TFSA withdrawals are tax-free, which is especially advantageous for low-income seniors who may be eligible for GIS or other benefits.

Important Considerations: TFSAs can be used to supplement other retirement income sources or serve as a savings account for unexpected expenses without impacting your taxes or benefits.

Locked-In Retirement Account (LIRA) & Life Income Fund (LIF)

A Reliable Source of Retirement Income for Former Pension Holders

For seniors who have left jobs with employer pension plans, a Locked-In Retirement Account (LIRA) provides a way to preserve pension funds until retirement. At retirement, these can be converted into a Life Income Fund (LIF), which offers regulated annual withdrawals.

Key Benefits for Seniors: LIFs provide a secure, consistent income stream while ensuring that funds last throughout retirement.

Important Considerations: LIF withdrawals have annual limits based on age and account balance, helping ensure that savings are preserved over the long term.

Non-Registered Accounts

Flexible Investment Options Beyond Registered Plan Limits

Non-registered accounts offer unrestricted savings and withdrawals, ideal for those who have maximized contributions to other registered plans. While these accounts do not provide tax advantages, they allow seniors to access funds at any time.

Key Benefits for Seniors: Non-registered accounts have no contribution limits or mandatory withdrawal requirements, making them a flexible option for managing larger retirement portfolios.

Important Considerations: Gains and dividends are taxable, so they are best suited for investments intended for long-term growth rather than frequent withdrawals.

Income Annuities

Stable, Predictable Income for Life or a Fixed Term

Income annuities convert your savings into a guaranteed income stream for a set period or for life, ensuring stability regardless of market conditions. Seniors can choose from options like term-certain, life annuities, or variable annuities.

Key Benefits for Seniors: Annuities provide predictable income, shielding your retirement funds from market volatility. Life annuities offer payments for life, ensuring that you won’t outlive your retirement income.

Important Considerations: Annuities are generally best suited for those who want steady, guaranteed income and are less concerned about leaving funds to heirs.

Most seniors or retirees move their money to low-risk or "safe" investments like GICs, money market funds, Treasury bills (T-bills) and bonds when they are nearing retirement or has retired. However, the low rates offered by these safe investments may be eaten up by inflation rate. In effect, they are losing their money instead of gaining money from interests.

One option that soon-to-retire seniors or those who are already enjoying retirement may not know is that they can invest their money in a safe investment that guarantees their principal is protected and they have the chance of earning higher interest.

Market-Linked Term Investment: Balanced Growth with Capital Protection

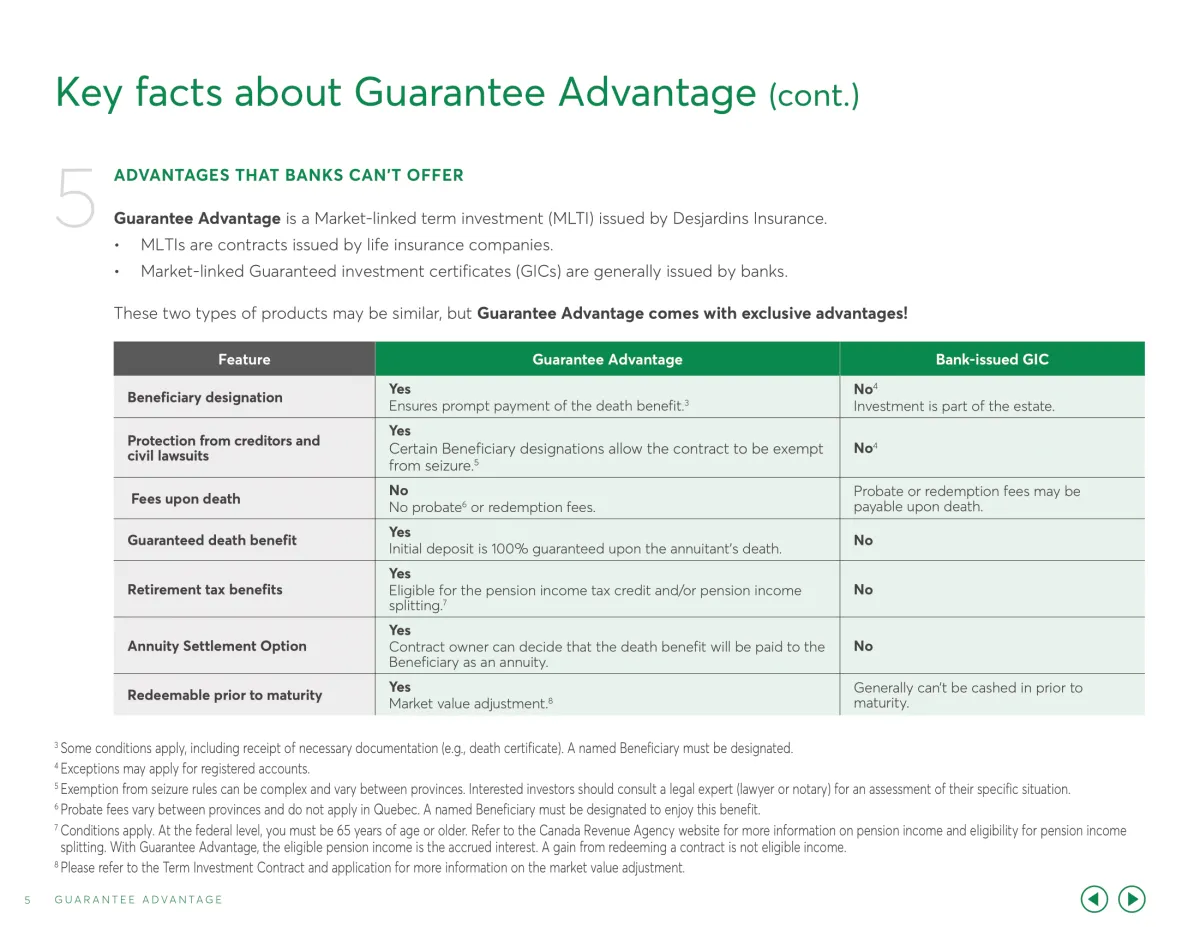

Desjardins’ Guarantee Advantage is a term investment whose returns are tied to a basket of securities from one or more sectors. It offers a guaranteed minimum return, and the principal is guaranteed at maturity and death. It’s a convenient way to get an optimum combination of capital protection and growth potential.

Key Benefits for Seniors: Guarantee Advantage offers growth potential while securing the principal at maturity and in the event of death. Additional benefits, such as the ability to name a beneficiary, ensure that funds are passed on efficiently.

Important Considerations: Guarantee Advantage investments carry a guaranteed minimum return and a capped maximum return, balancing risk and reward. Seniors can choose to allocate funds into responsible investment baskets.

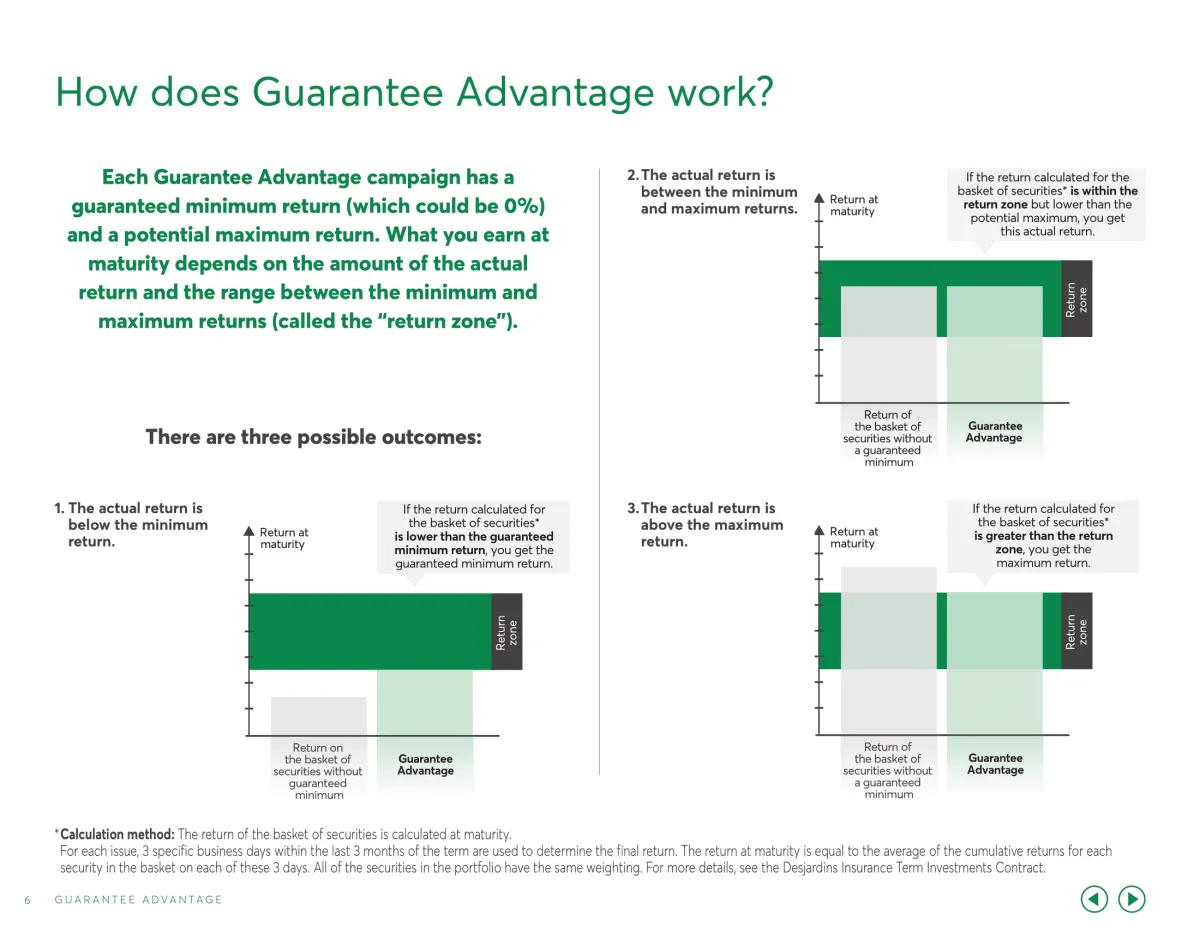

Here's how it works:

benefits:

Secure Your Future with Personalized Advice

Working with an advisor helps you make informed decisions that align with your retirement goals. Consider creating an Investment Policy Statement (IPS) to define your strategy, helping you and your advisor make consistent, unemotional choices in all market conditions.

*Contact us today to learn more about retirement investment options tailored to seniors.

Frequently Asked Questions

What is the best way to generate steady retirement income from my RRSP?

Once you turn 71, your RRSP can be converted into a Registered Retirement Income Fund (RRIF), which provides regular, taxable income through structured withdrawals. This approach is tax-deferred and provides flexibility, but withdrawals are mandatory each year, and the income is subject to tax.

How does a Tax-Free Savings Account (TFSA) benefit me in retirement?

TFSAs allow you to grow savings tax-free, and withdrawals do not impact your taxable income or eligibility for income-tested benefits like the Guaranteed Income Supplement (GIS). This makes them an excellent option for low-income seniors or for covering unexpected expenses without affecting benefits.

What are LIRAs and LIFs, and how can they help me with retirement income?

If you have a workplace pension and leave before retirement, funds can be transferred to a Locked-In Retirement Account (LIRA). At retirement, the LIRA can be converted into a Life Income Fund (LIF), which provides steady income with regulated annual withdrawal limits, ensuring that funds last throughout your retirement.

How do annuities work, and are they a good choice for seniors?

Annuities convert a portion of your savings into a guaranteed income stream for a set period or for life. They provide stability and protect against market fluctuations, making them ideal for seniors who want predictable, reliable income. Options include term-certain and life annuities, each with unique benefits for income security.

What is the Desjardins Guarantee Advantage, and how does it protect my savings?

The Desjardins Guarantee Advantage is a market-linked term investment offering growth potential without risking your principal. It provides a guaranteed minimum return with capital protection at maturity and in the event of death, making it a safe option for seniors looking to balance growth with security.

Are non-registered accounts useful for retirement savings?

Non-registered accounts are flexible and allow unlimited contributions and withdrawals, ideal for seniors who have maximized registered accounts like RRSPs and TFSAs. Though they lack tax benefits, they offer flexibility for those with larger portfolios and minimal tax implications if focused on capital gains or eligible Canadian dividends.

What is a Market-linked term investment?

A Market-linked term investment is a term investment whose returns are tied to a basket of securities from one or more sectors. It offers a guaranteed minimum return, and the principal is guaranteed at maturity and death.

What is a Basket of securities?

A Basket of securities consists of securities of publicly-traded companies whose brands, products and services are recognized and commonly used. In a way, it's a benchmark that serves to calculate the term investment's variable return.

What is a Beneficiary?

The Beneficiary is the person designated by name who will be paid the death benefit upon the annuitant's death.

At Senior Secure Canada, we specialize in providing financial solutions that ensure guaranteed income for life, helping you retire with peace of mind. With personalized strategies tailored to your needs, we help you navigate retirement without the stress of market risks.